Home »

Multisig Guide | 8 Steps to Setup Multisignature

Learn to Setup Super Secure Multisig with Hardware Wallets

The Most Secure Way To Secure Generational Wealth

- Learn to setup multisig with hardware wallets (secure & easy!)

- Sovereign multisig, Collaborative Custody or Multi Institutional

- Learn the difference between multisig and singlesig

- Understand the importance of the wallet configuration file

- An 8 step setup from plan to funding

What is multisignature?

You heard that multisig is an extremely secure way to store your Bitcoin, but what exactly is multisig? How can you set it up? What do you need for the setup? If you have these questions: Please read on. You will learn it all with this multisig guide!

Multisig or multisignature is a Bitcoin native technology to create an extra secure Bitcoin address by combining multiple private keys (?). With a standard Bitcoin address the ownership of the bitcoins rely on one private key. If you lose this key or if it gets stolen, your bitcoins are gone.

Multisig eliminates the private key as a single point of failure by using multiple private keys to control the bitcoins in one address, while not all the keys are needed to control the bitcoins. This means that one or more keys can get lost or stolen, without losing your bitcoins.

Multisig with Hardware Wallets

Because the high security and ease of use we are focussed on multisig with hardware wallets. This means that you use multiple hardware devices to create one multisig address, while only a part of these devices have to sign to make a transaction. When you distribute these devices and / or the backup over different locations, you won’t lose your bitcoins if something bad happens at one of these locations.

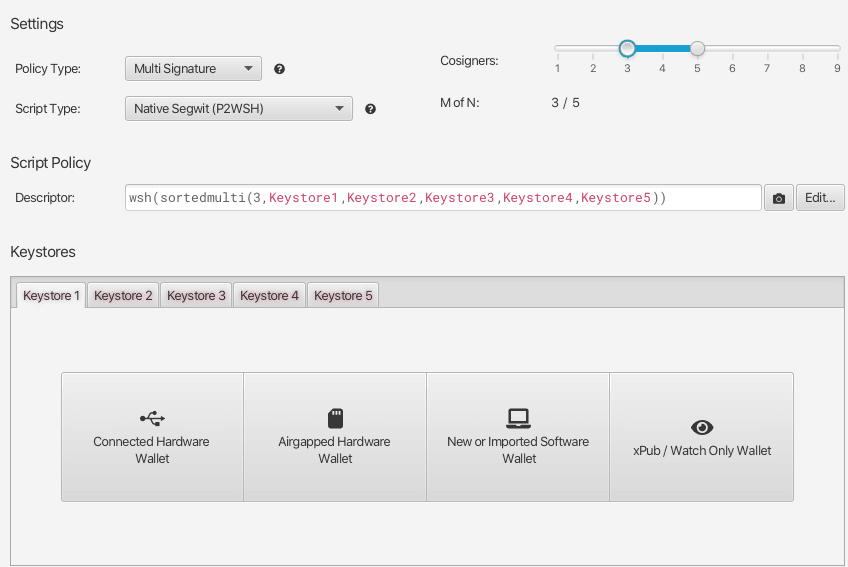

You decide how many keys are involved and how many are needed to control the funds. This is called the quorum (?) and can be set in the multisig wallet. The quorum is displayed as M-of-N, which means ‘the minimum of signatures required’ out of ‘the total number of signers’. The minimum required signatures is known as the threshold (?).

Popular quora are 2-of-3 and 3-of-5. In the first are 3 hardware wallets involved and 2 have to sign to make a transaction. In the latter are 5 devices involved and 3 are needed for a transaction. In the first quorum 1 key can get lost or stolen without losing control over the coins in the address, in the latter you’re still fine if you lose two keys.

Multisig Cold Storage | The Safest Way to Store Bitcoins

Multisig and cold storage (?) are both enhancing the security of your bitcoins in a very big way. Cold storage means that the private keys are created and stored offline, which makes hacking practically impossible. It used to be hard and complicated, but hardware wallets made it very easy and accessible.

A hardware wallet creates the private keys offline on the device. As long as you take care that you keep de seed (?) offline, the private key will never touch the online environment. This means that hardware wallets if used properly are cold storage devices by default. This makes multisig with hardware wallets so robust.

The hardware wallets not only keep your keys extremely secure, it makes the setup very easy too. Hardware wallets are directly integrated in the multisig wallets, so you just have to understand the basics of multisig and follow the prompts on your screen and on the device.

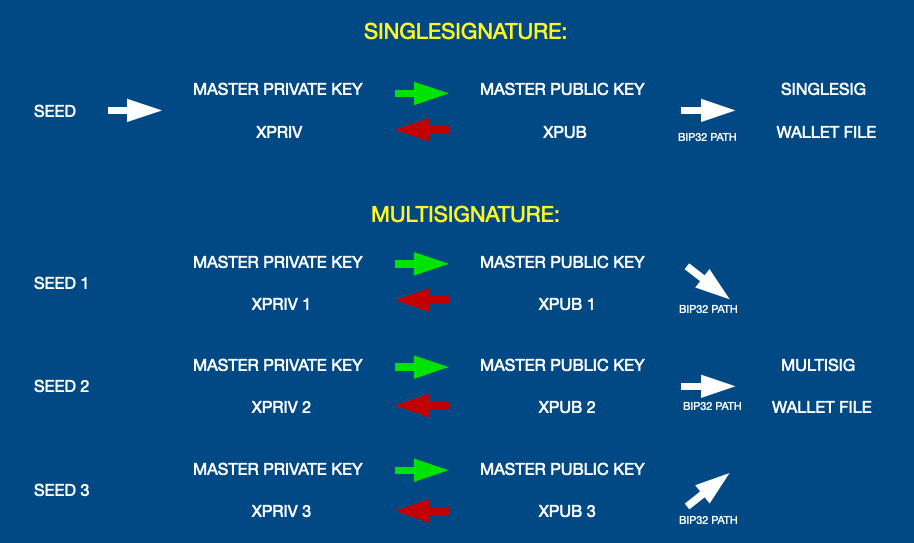

What is the Difference Between Multisig and Singlesig?

Singlesig is just a default Bitcoin wallet. Your wallet is based on one backup seed, this seed is the key to your bitcoins. The advantage of singlesig is that it is super simple. You just have to backup your seed and don’t have to worry about the wallet file, because your wallet can always derive this from the seed.

The downside is that your seed is a massive single point of failure. If someone find or steal your seed, they have your bitcoins. If you lose or destroy your seed, your bitcoins are lost. You can protect your seed with a passphrase. However, a passphrase is a tradeoff. It makes theft harder, but loss more likely (if you forget your passphrase).

Multisig is more complicated, because you have to store multiple seeds separately and you have to backup your wallet configuration file. However, your seeds are no single point of failure, even after loss or theft of one or (depending on your quorum) more keys you can recover your bitcoins.

If the keys are properly distributed, the chance that something happens with multiple keys at the same time is theoretically extremely small and practically non-existent. This makes multisig extremely secure and highly recommended for bigger stacks.

The Bitcoin network itself doesn’t have a single point of failure, but with singlesig your wallet does. Multisig fixes this! It eliminates every single point of failure!

The Wallet Configuration File

Wallet file and wallet configuration file are words for the same thing: A backup of your multisig wallet. When you create your multisig setup, you have to register all your signers one by one. You connect them and register your master public keys (Xpub) (?) and the derivation paths (?) in the multisig software.

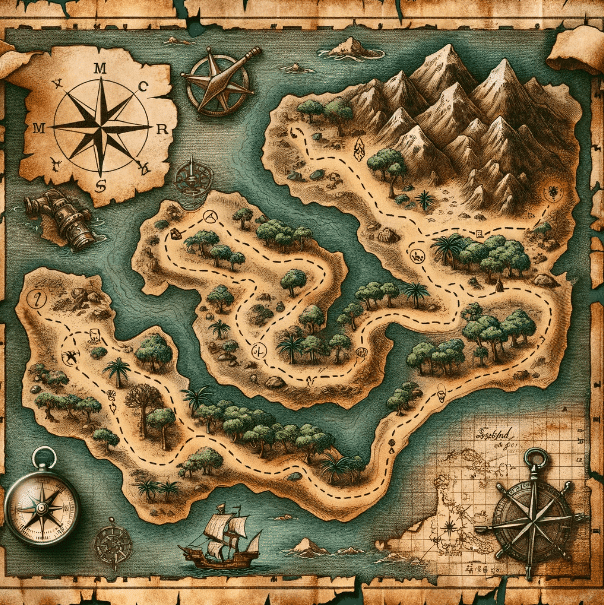

This is an easy process where you just follow the prompts in the multisig wallet and on your hardware devices. After you register all your signers, your multisig wallet is ready to go. However, it’s extremely important to backup your wallet file, which contains all the Xpubs and derivation paths. It’s a map to your multisig address (?).

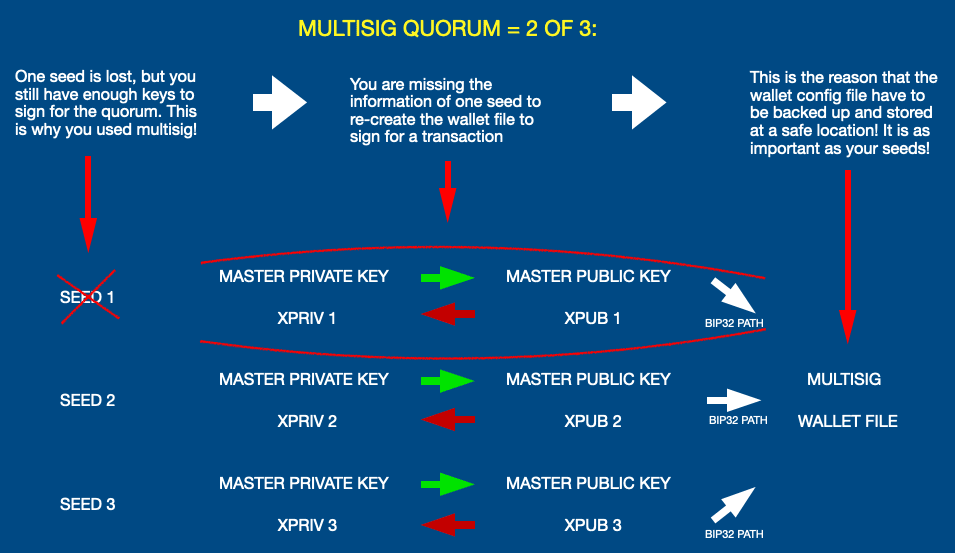

Why Is the Wallet File Important?

The private keys are critical, because without enough keys you won’t be able to sign for a transaction and your Bitcoins will be locked forever. However, the wallet file is evenly critical, because without it you won’t be able to find the address to sign for with your keys.

You can consider the private key the password to open a treasure chest and your wallet file the secret map to get to the chest. If you don’t have the map to find the chest, the keys to open it are worthless. We see this as the biggest risk and downside of multisig, but if you know it and properly backup your wallet file it isn’t a problem.

If you still have all your private keys you can re-create your wallet file. Once you lose one you can’t, because you can’t derive the Xpub of this signer anymore. Now you can only recover your bitcoins by first opening your wallet with your wallet file, and then signing for the recovery transaction with the remaining keys.

How to backup the wallet configuration file?

You can make a backup of your wallet file manually by copy / pasting your Xpubs and derivation paths, or you can export the wallet file or redeem information from your wallet. Now you can choose whether you want to store this backup with your private keys or separately.

If you store it separately, always make multiple copies because this information is highly critical. If you store it with your private keys, store a copy with at least as many keys as your threshold. This way you are sure that you always have a copy left when you have enough seeds left to control your bitcoins.

For your storage decision it’s important to realise that theft of your wallet file will be a privacy issue, but won’t lead to loss of your bitcoins. This means that you don’t have to store them strictly offline like your seed. You can use online methods like password managers, encrypted folders on your computer or watch only wallets on your online devices.

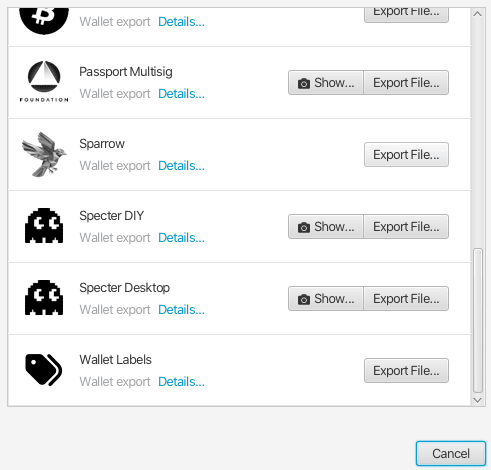

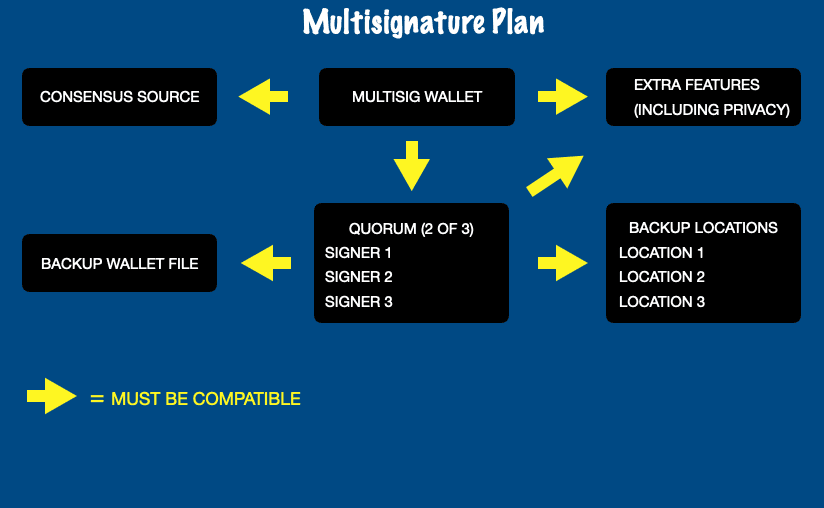

7 Different components of a multisig setup

There are 7 parts in a multisig setup. You have to consider all of them before you get started, because they are interconnected. For example: If you want a multisig setup with 5 hardware wallets, you need to find 5 secure storage locations to store your backup. Furthermore, your multisig wallet have to be compatible with your chosen hardware wallets and compatible with the consensus source you want to use. Below the 7 components of a multisig setup:

Multisig Signers

Multisig means that control over your bitcoins is shared over different signers. You have to decide how many signers you use and how many will be required to sign to maken a transaction. The more signers you use in your quorum, the more secure it is, with the tradeoff that it’s more complicated too

The higher your threshold is, the better you protect against theft. However, a higher threshold makes loss more likely. You have to make these trade-offs for yourself. In general 2-of-3 is optimal for a simple setup, while 3-of-5 is optimal for a more advanced setup.

Use Hardware Wallets

You use any wallet as a signer your multisig setup, but we really recommend hardware wallets. Hardware wallets are not only compatible and extremely easy to use, but they also keep your keys offline by default, which adds cold storage to your setup and makes it practically unhackable.

The ratio between ease of use and security of hardware wallets is off the charts, other methods of cold storage aren’t even coming close. Cold storage was very complicated before hardware wallets, now even a child can do it!

To avoid single points of failure in your setup, we recommend to use different hardware wallets for every signers. It’s also important to order your hardware wallet directly from the manufacturer, which cuts out the middlemen and the associated risks. If you want to choose your signers first, click the button below!

Multisig Wallets

Next, you have to choose your multisig wallet. This is software that allows you to connect the signers, get information about your addresses by connecting with a consensus source and make transactions. It’s the software that gives you the interface and brings everything together. It’s basically the same as a normal Bitcoin wallet, but with extra multisig functionality.

You can download all multisig wallets that we recommend for free. Some have an optional paid plan for extra services like collaborative custody and / or inheritance. The wallets have different features, so for customisation of your setup you should consider those. You also have to check whether the hardware wallets you want to use are compatible with the multisig wallet of your choice. To compare and download multisig wallets, click the button below!

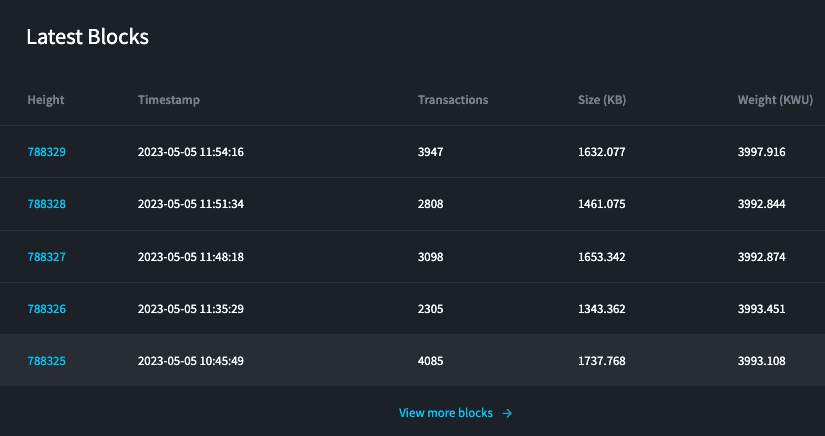

Consensus Source

The consensus source is software that connects to the Bitcoin blockchain. It allows you to see the balances of your addresses on the blockchain and see them in your wallet. Some multisig wallets have a consensus source build in, some allow you to connect one and others connect automatically.

By connecting to your own full node you can be fully self sovereign. It protects your privacy, because you don’t have to tell anyone what your Bitcoin addresses are. Furthermore, you don’t have to trust anyone to give you the right information and you can check and enforce your the network rules.

An easier way is to connect to a block explorer. You don’t have to run your own software, but you have to trust the service you use to give you the right information and to enforce the right network rules. It can also hurt your privacy: You leak your addresses to the service by requesting information about them.

Especially when you have a bigger stack of Bitcoin, we always recommend to run your own node. It’s the only way to become a first class citizen of Bitcoin who is fully self-sovereign. You can run one on a specialised device, or on your computer.

Backup wallet file and seeds

You have everything for the basic setup of your multisig, now you have to decide how you will make your backups. You can backup your seeds on paper or extra robust on stainless steel. Further, you can use more exotic ways like memorising, boarder wallets, Shamir’s Secret Sharing or hide your seed through several ways of encryption.

It’s important to realise that increased complication will increase the risk, so we generally advice to store your seed on paper or metal in a secure place. However, your customisation could allow for extra risky methods when the keys with extra risk are less than the setup allows you to lose according to your threshold.

For example: A memorised key can allow you to access your bitcoins globally without the possibility to be confiscated by boarder security, while you can easily rotate this key out if you forget it. It enables you to travel with your bitcoins in a highly secure way.

Storage of the wallet file

Then you have to decide for your wallet file. Do you store it with your private keys or separately. The advantage of storing it with your keys is that it’s less complicated, because you have information stored in less different places.

The downside is that if someone steals one key, they can see your setup too. This makes it clear for them how many more keys they have to steal and how many bitcoins it will gain them. If you store your wallet file with keys in case of a 2-of-3 or 3 keys with a 3-of-5 you will always have a wallet file left as long as you have enough keys. You can also store it with all your keys.

If you store it separately you can store it in an encrypted folder or as a watch only wallet on your computer, in a password manager or in a safe location on a USB stick or SD card. Writing or printing it on paper is not a good idea. There are way too many characters, so recovery will be complicated.

Storage Locations

An important part of your multisig setup is where you store your keys. You have to distribute them over different secure locations to really eliminate all single points of failure. If something can happen with multiple keys at the same time, it defeats the purpose of using multisig.

Storage can be done in an easy and convenient way, extremely secure or everything in between. The trade-off here is ease, cost and accessibility against security. Generally, the more secure your keys are stored, the harder it is for yourself to access them too.

An example of an easy, cheap and accessible setup would be a 2-of-3 where the keys are stored in your house, in a friends house and in a locker at the local bank. An extremely or even ultimately secure setup would be a 3-of-5 with all keys stored in private vaults on different continents and in countries with strong property rights and no treaties with each other.

Obviously, the first is extremely easy and cheap to setup and if you want to spend your bitcoins they are easily accessible. The latter is extremely secure and even protects against crazy threats like torture, confiscation and nuclear war. The security level of this setup far exceeds every legacy method to store wealth.

However, the setup is expensive and takes a lot of travel to distribute the keys. If you want to acces your coins you have to travel to 3 different continents. A large variety of other setups between these two extremes are possible. You are the only one who can make the right trade-offs. It’s up to you what you prefer.

Don’t let the ultimate secure setup overwhelm you: This is only necessary for the ultra-rich or people who might become a target. For most people an easy and accessible setup is already very secure.

Privacy

Did you hear the following argument about privacy? ‘If you have nothing to hide, you don’t need privacy’. This is total BS! Especially in Bitcoin, privacy is the cornerstone of security. If nobody knows that you own Bitcoin, nobody will try to steal them!

Who do you think is at bigger risk? Someone who bought his bitcoins privately or someone who bought his bitcoins on an exchange with KYC, his information got leaked on the dark web and criminals from all over the globe now know exactly how much he owns and in how many wallets it’s stored?

Protect your privacy

To protect your privacy you have to choose a multisig wallet that enables you to do so, acquire your bitcoins in a proper way and use them without exposing your identity. There are 3 areas of Bitcoin privacy:

- Ensure that your Bitcoin addresses can’t be linked to your identity

- Ensure that your IP address can’t be linked to your blockchain activity

- Ensure that your addresses can’t be linked to each other

For the first you can avoid KYC, consider mixing and be aware when you spend your bitcoins. The second can be done by using TOR and do as much as possible offline. For the third you can change addresses for every transaction, use UTXO selection and consider mixing or pay joins.

For most of these privacy tools you need a multisig wallet that support these features. If privacy is important to you, consider this when you choose your software!

Extra Features

There are several extra features that you can use to customise your multisig setup. You can use them to add security, make recovery easier, enable inheritance or add payment conditions. If you want to have certain features, you should carefully consider which multisig wallets and hardware wallets to use. Below some available features:

- Passphrases

- Shamir’s Secret Sharing

- Roll ’n Dice

- Timelocks

- Decaying Keys

- Air-gapped Signing

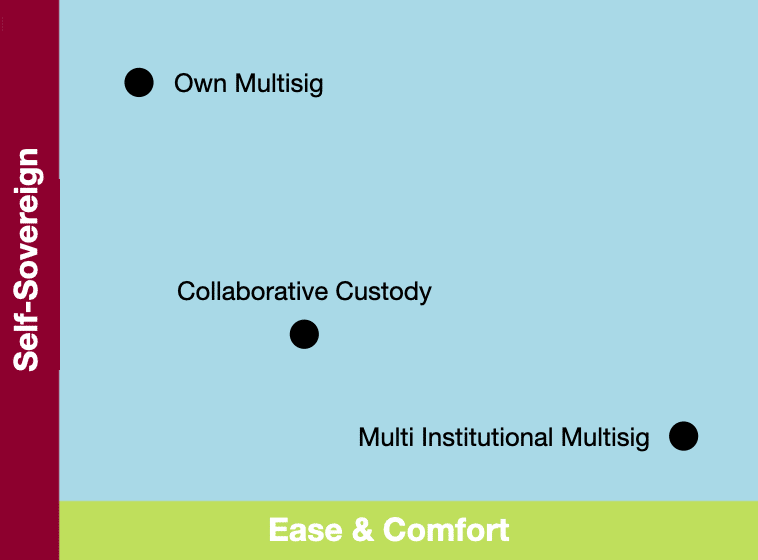

3 Multisig Variations

Are you a diehard Bitcoiner who loves to learn, to be self-sovereign and get maximal security for your Bitcoin stack? Do you want the security of multisig, but you don’t have the confidence to do everything by yourself? Or do you need the security level of multisig, but you have no time to do anything yourself or you are legally not allowed to hold your own keys?

In all these scenario’s you can enjoy multisig! This is the reason we think everyone with a relevant Bitcoin holding should at least consider it. It’s the optimal secure way to hold Bitcoin and even the optimal way to hold wealth in general. If you don’t use it, you’re missing out!

Variation 1 - Setup everything by yourself

If you feel comfortable setting up multisig by yourself, then do it yourself! You need to educate yourself a little bit, especially understanding the importance for backing up your wallet configuration file is critical. However, your effort will be rewarded. You’re 100% self-sovereign with your money and not depending on anyone else for the safety and availability of your money!

If you want to setup multisig by yourself, the rest of this page will help you step by step to do so. Only start when you feel knowledgable enough, you have to understand what you are doing. If you don’t, the next way might be better to start with.

Variation 2 - Assisted Multisig or Collaborative Custody

If you don’t feel comfortable setting up multisig by yourself or you just don’t want to go that deep, you can use assisted multisig or collaborative custody. The genius of this setup is that you cooperate with an expert who delivers the software, knowhow and takes partly care of your backups, without taking control over your money.

The most common setup is a 2-of-3 where you hold two keys and assisting party hold one key. This means that you can fully control the bitcoins in the address with your two keys, while the assisting party can’t touch them. However, if you lose one key the assisting party can deliver the 2nd signature to recover your coins.

The advantages of collaborative custody:

- One key is trusted to the assisting party, you don’t have to worry about security and storage of this key

- The assisting party has your wallet configuration file. This makes your backup less sensitive, because they can give it to you if you lose it.

- Collaborative custody providers usually include inheritance plans to give your bitcoins to your heirs in a secure way after you die.

- Your setup ‘feels’ like a normal app or exchange, which is user friendly and gives comfort.

- You can smooth into multisig by using the knowhow and customer support of an expert, while being involved yourself too. It’s an easier way to get into multisig. You don’t carry all the responsibility alone.

- Collaborative custody providers often deliver extra financial services based on sound finance. Because you own a part of the keys and the funds are visible on the blockchain, you know fraud and rehypothecation is not possible.

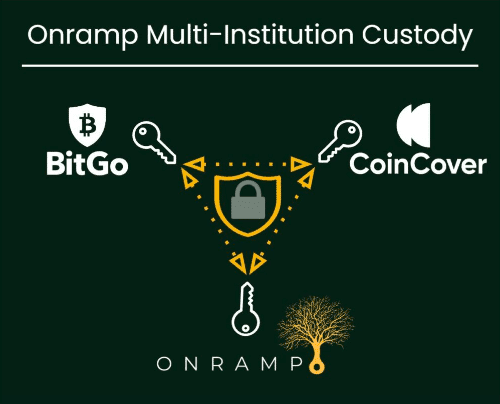

Variation 3 - Multi Institution Custody

If you are a HNWI or an entity that doesn’t want to handle keys or is not legally allowed to, there is still a much better option than giving your bitcoins to a third party. With multi institutional custody your bitcoins will be deposited in a 2-of-3 multisig whereby three different custodians hold a private key.

This means that bankruptcy or fraud within one custodian won’t lead to the loss of your bitcoins. Two custodians would have to collaborate to steal your funds, which is magnitudes less likely. Additionally, you can audit your funds on the transparent blockchain, which ensures that the funds are really there and aren’t rehypothecated.

The multi institution custody provider we recommend is Onramp. They will hold one key and reputable Bitcoin companies like BitGo and Coincover will hold the other keys. To send your bitcoins two of those institutions have to sign.

8 Steps How to Setup Multisignature - Step by Step guide

Now you know the basics of multisignature, it’s now time to set it up. We will describe the process step by step, so that you can be sure that you don’t forget anything. Note that you don’t have to send all your bitcoins to the newly created multisig. We even advice to not do that.

It’s best to start off with a part of your bitcoins and leave the rest in your current storage solution. With time you will feel more comfortable with your setup, just let your bitcoins flow to the setups where you feel best about.

This will not only ensure that you are diversified between different solutions, but also that your bitcoins will eventually move to the safest setups. With diversification between setups you can think about singlesig with hardware wallets, collaborative custody and multisig setups. Only if you currently have your coins on an exchange, get them off to your hardware wallet today!

These are the steps to setup your multisig:

Step 1 - Plan your Multisig Setup

First you have to decide every detail of your setup. What is your quorum going to be? Which hardware wallets will you use? Which multisig wallet are you going to use? Do you want to customise for extra features, privacy or inheritance? Do you have enough places to store your keys?

It’s important to answer these questions first, because they have to match each other. If you choose your hardware wallets, you have to make sure that they are compatible with your multisig wallet. If you choose your quorum, you have to be sure that you have enough storage locations. Especially for extra features you have to check whether your soft-and hardware supports it.

Write it all down, consider whether you will feel secure with this setup and check if everything is possible. Go over the threats you are worried about, and see whether your intended setup protects you.

Step 2 - Get all the Multisignature Tools

Once you are certain about your plan, you can go ahead and get all the tools you need. Download the multisig wallet for free, order the hardware wallets directly from the manufacturer and reserve your storage locations.

You might use metal backup plates, faraday bags, tamper proof envelopes ect, order them too. Further you probably need USB sticks or SD-card for your wallet file, and / or setup an account with a password manager if you plan to use it.

Step 3 - Setup the Signers and Make Backups

As soon as you receive all your hardware wallets, you can proceed with the setup of each device. Follow the setup procedure as given by the manufacturer and be sure to backup the seed of each device. The seed is the 12 or 24 words the device will prompt you to write down. This is your key, so be very precise with this step.

After you write down your seed or immortalised it on stainless steel, it’s advised to put it in a tamperproof envelope. Be sure to properly mark the envelope, you you can later see which key it is. In this step you can also setup your passphrases if you use them. Now your signers are setup for the multisig!

Step 4 - Register the Signers in the Wallet and Connect the Consensus Source

Now it’s time to really setup your multisig! Open your multisig wallet and set the quorum you’re going to use. Set the consensus source and connect to your node if this is your choice. If you use a blockchain explorer, it will be connected automatically after you select it.

After selecting the quorum, there will be an option to register a signer for every key. If the hardware wallet is supported by the multisig wallet, you can just select the type of your device and follow the prompts to connect it. The wallet will extract the Xpub and the derivation path from the device and use it to create your multisig.

You have to do this with every device. It’s just a matter of following the prompts. Hardware wallets connected with a USB are generally easier, because it’s just pushing buttons. For the more secure air-gapped hardware wallets you have to transfer the information by QR or SD-card between your hardware wallet and the device where your multisig wallet is on.

Some hardware wallets enable you to register the multisig on the device. This ensures that the hardware device ‘knows’ where it signs for, which increases security. If this is the case for your signers, do this too! Your multisig is now ready, but your are not yet. Go to step 5!

Step 5 - Backup the Wallet Configuration File

We told you already how important the wallet configuration file is, it’s really critical critical. In this step you backup your wallet file or redeem information (which is the same) on USB sticks, SD cards, encrypted folders on your laptop or phone or in a password manager.

Digital information can decay, so always make multiple backups. If you backup your wallet file with the private key, it’s advised to backup it with the same or more keys than your threshold. It’s also advised to store multiple backups per key. For example: Store two SD cards with the backup together with your keys.

If you don’t store the wallet file with your private keys it’s also advised to store multiple backups. For example: Have a watch only wallet on your laptop, store the wallet file in a password manager and have two USB sticks with the wallet file at different places at home.

Step 6 - Test your Multisig Setup

Before you send money to your setup, it’s wise to test your setup first. Send a small amount of Bitcoin to your multisig address. Then you delete your wallet and try if you can recover it with your wallet file. Then try to send the small amount of Bitcoin back using your signers. Now you are sure that you have all the information you need to recover your wallet and that you will be able to spend from it!

Step 7 - Distribute the Private Keys

Step 7 and 8 can be done in any order, but we believe that it’s safer to distribute the keys first. This way you don’t have to travel with keys that give access to your bitcoins. You can store the hardware devices together with the keys, or separately. Together is obviously much easier, but if you separate them you get another layer of security.

You can also store only the seed or only the device. We don’t recommend to only store the device, but a service like Casa is recommending this for their clients. If you choose to do this, please follow all their other recommendations to decrease the risk as much as possible. Again, it’s better to just always store your seed.

If you distribute the keys internationally, this step is a lot of work. You have to travel to all your locations, rent the vault and store your seed and / or device. Especially in this case, it’s better if there is no Bitcoin in your address yet. You travel only with keys, not with assets that might have to be declared. If you store all keys in your own city, you might as wel fund your multisig address first.

Step 8 - Fund your Multisig Address

You’re almost done! Your multisig address is ready, you just have to send your coins to the address. There are two options: Or you send everything in one transaction, or you use a wallet that supports UTXO selection and send it in multiple batches.

Using multiple batches makes transactions both in and out of the wallet less scary, because you just transact with a part of your holdings every time. However, it’s important to keep the size of the batches big enough, so that the transaction fee isn’t a problem if fees get extremely high in the future.

If you send your bitcoins to the address be very sure to double check the address. Malware on the online device could manipulate the address while you copy / paste it. The only way to be sure is checking the entire address, not just the beginning and the end!

Test and Upgrade your Multisig Setup and Diversify

You have your multisig setup ready, but you should still maintain its optimal status. Data can degrade, software and hardware can loose compatibility, new and better tech will come out and you can forget how your setup is done. Maintenance of your multisig can be done in the following ways:

Periodically Test your Multisig

Testing your setup brings in some minor privacy risk, which means that you have to decide for yourself how often you want to test. A sweet spot might be about once a year, where you don’t expose your setup including Xpubs and UTXO’s online very often, while you will probably be in time to catch problems before they become critical. To test your setup you undertake the following actions:

- Upgrade all the hardware and software

- Recreate your multisig wallet with your wallet configuration file or other backup information

- Do a key check for the keys you can access

Upgrade your Multisig and create new setups

Our advice is to diversify between different setups to secure your Bitcoin so that one setup won’t be a single point of failure. You can have a part of your digital wealth in singlesig + passphrase, another part in collaborative custody, another part in an easy to access 2-of-3 multisig and another part in an ultra secure globally distributed 3-of-5 multisignature. Of course using all these setups is only suited for the Bitcoin rich, for most people it will be massive overkill.

However, while your Bitcoin wealth grows you can build out more setups getting more advanced over time and slowly spread your money over them. You will probably not feel super comfortable with a brand new setup: So we recommend to fund a new setup with just a little bit and increase it while you start to feel more comfortable as time passes.

This way your coins will naturally flow to the most secure setups where you feel most comfortable with, while your older and less secure wallets slowly become empty. If you want to safe some money you can plan your upgrades around Black Friday, then you can get double digit discounts on almost all the hardware wallets and especially with bigger quorums this will safe you a lot of money!

It’s also advised to use the bear markets to upgrade. Hardware wallets are generally cheaper and more available in those years and transaction fees are lower. Prepare your perfect multisig in the bear market, so you can lean back and enjoy your gains in the bull market!