Home »

Bitcoin Inheritance | Leave Your Bitcoin to Your Loved Ones!

Allow your Spouse to Inherit your Bitcoin with a Smart Multisig Setup

With Bitcoin inheritance you are sure that your bitcoins won’t die with you!

- Have your Bitcoin stored extremely secure during your life

- Be sure your spouse can claim your Bitcoin after you die

- You decide whether you want to include trusted 3rd parties

- Hard money deserves long term planning!

- The best collaborative custody services that provide inheritance

What is Bitcoin Inheritance?

Did you ever consider what will happen to your Bitcoin if you die? Do you want your wife or children to enjoy your wealth if you’re not here anymore? If you have your bitcoins in a standard cold storage (?) wallet, your coins will probably permanently leave this world together with you.

Bitcoin inheritance used to be a hard problem to solve, because Bitcoin ownership fundamentally relies on the knowledge of a secret (private key (?)). If you give this secret to your heirs during your life, it harms the security of your coins. Worse case they can even steal them.

If you don’t give them the secret during your life, they won’t be able to recover your coins when you are gone. With multisig, smart use of Bitcoin script and / or trusted 3rd parties, you can create an inheritance setup that keeps your bitcoins secure during your life, while your heirs will be able to get them when you die.

How Does it Work?

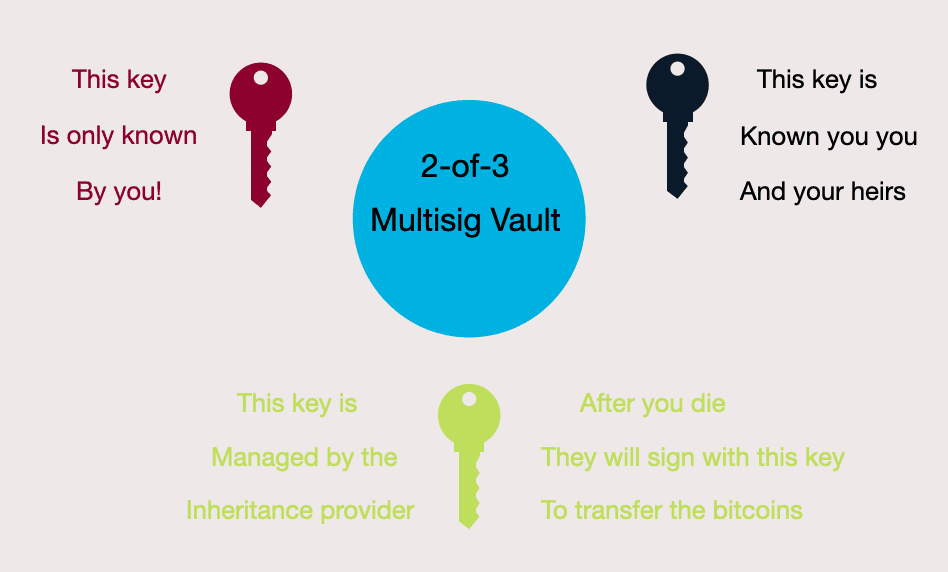

Bitcoin inheritance generally works by using multisig in a smart way. The multisig is setup in a way that the hears who will inherent the coins get access to one key less than the threshold (?). This means that they can only recover the coins if they get one more key.

Transferring access to the coins in the multisig to your heirs can be done in two ways: Programatically or with a trusted 3rd party. The first option is fully self-sovereign, there are no 3rd parties involved! It can be done with certain settings in your multisig wallet using decaying keys (?) or timelocks (?).

It enables your heirs to control your bitcoins after a certain time with the keys they already own, because the threshold gets lower or a partly pre-signed transaction becomes valid. If you don’t die, you just upgrade the setup before the execution date and reset the time.

The latter option includes a 3rd party who controls one key. This can be a lawyer or a collaborative custody provider who signs for you or hands the secret to your heirs after some pre-arranged checks. Both options can be combined in more sophisticated setups.

Best Bitcoin Inheritance Providers

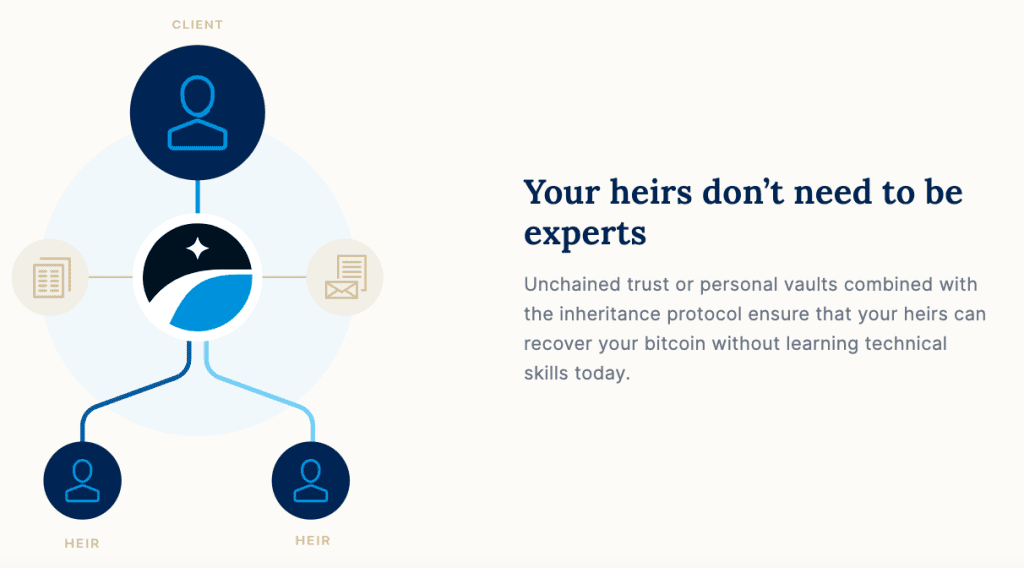

You can setup Bitcoin inheritance by yourself using a multisig wallet with the right features, but you can also use a service to make it easier and smoother. All the collaborative custody providers that we recommend on our site are providing Bitcoin inheritance.

They help you to secure your stack during your life, and with the transfer of your bitcoins after your life. Because collaborative custody providers hold one private key as a backup anyway, it’s very easy for them to provide inheritance. They can just sign for the heirs after certain conditions are met.

The Bitcoin Adviser

Do you want a personalised multisig setup including an inheritance plan for your bitcoins? The Bitcoin Adviser is providing Bitcoin wealth management services, education, collaborative custody and inheritance.

If you have a high net worth, but no time to figure Bitcoin stuff out by yourself, they can guide you through the process of setting up a multisig solution that protects your bitcoins during your life and ensures smooth and secure transfer to your heirs after you’re gone.

The Bitcoin Adviser uses different multisig wallets and has connections with different collaborative custody providers, so you can customise your setup to your own situation and priorities. The partners are all well known and respected bitcoiners, so you can choose someone to guide you who you like and trust!

Unchained

Unchained is a financial institution that delivers sound financial services on top of secure and auditable multisig vaults. You can create a vault for safe long term HODL or for financial services like lending, IRA’s and more. On those vaults you can add an inheritance plan.

Unchained is one of the pioneers in collaborative custody and very respected in the Bitcoin industry. They developed their own open source multisig software, that you can use to recover your coins without the help of Unchained.

Casa

Casa is a multisig and inheritance provider that enables you to HODL Bitcoin, Ethereum and USDt in a multisig vault. The inheritance process is simple and private. This means that you don’t have to KYC and don’t have to deliver documents to Casa.

You will share the mobile key with your heirs during your life. They can import it with a QR code into their Casa app. If the sad moment comes, they can start the inheritance process in the app and a waiting period of 6 months will be initiated.

You will get notifications all the time to be sure that you are really not alive anymore. If there is no activity from your part in those 6 months, Casa will sign with their key and the coins will be transferred to the Casa app of your heirs.

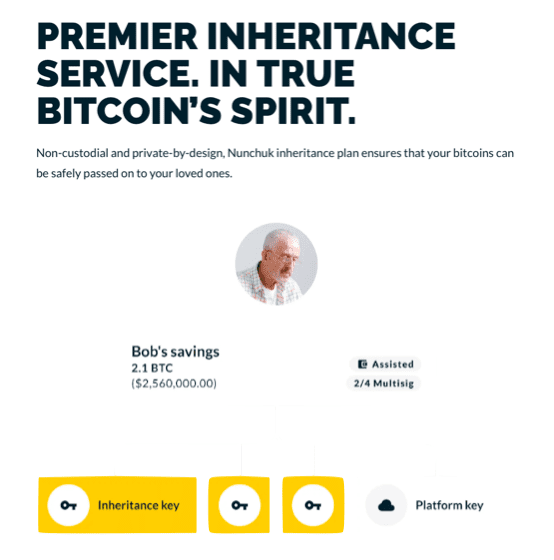

Nunchuck

Nunchuck is a multisig wallet, but with a paid plan you get the advanced miniscript features. The paid plans include a 2-of-3 multisig vault, a 3-of-5 multisig vault and a 2-of-4 inheritance setup. In the inheritance setup there is an inheritance key and the platform key that will eventually sign for the transfer to your heirs. The other two keys are hardware wallets under your control.

The inheritance key consist of a magic phrase and a backup password. After a set time delay decided by you, these two secrets together give control over the inheritance key. It’s split in two secrets so that you can give both to your heirs to claim it themselves, give both to a lawyer to claim it for them or give one to your heirs and one to a lawyer to create a hybrid setup.

Compare the Best Bitcoin Inheritance Services

Do you want a fully self-sovereign inheritance setup? Or do you want a legal expert like a lawyer involved? Maybe you see advantages in both and you want multiple setups with different configurations?

It’s important to pick the right provider that gives you the features you need. Further it’s important to compare the prices and consider whether the service you get is worth it. In the table below you can compare the best Bitcoin inheritance services and go straight to their official website.

| Provider & Service | Price | Quorum | Extra Services | Hardware | More Info | Sign Up! | |

|---|---|---|---|---|---|---|---|

| The Bitcoin Adviser Customised Inheritance | On Request | 2-of-3 | Advice, Education, Collaborative Custody | Coldcard, Trezor, Ledger | More Info | Sign Up! |

| Unchained Indirect Inheritance | $200,- | 2-of-3 | Private Vaults, Business Vaults, Loans, Buy Bitcoin, Bitcoin IRA, | Coldcard, Trezor, Ledger | More Info | Sign Up! |

| Casa Private direct Inheritance | Standard - $250 / Year Premium - $2100 / Year | Standard - 2-of-3 Premium - 3-of-5 | Multisig Vaults | Coldcard, Trezor, Ledger | More Info | Sign Up! |

| Nunchuck Direct, indirect or hybrid inheritance | Honey Badger - $450 / Year | 2-of-4 | Multisig Wallet, Multisig Vaults, Spending Conditions, | Coldcard, Trezor, Ledger, Keystone, Passport, Blockstream Jade, Tapsigner | More Info | Sign Up! |